I shared this clip in my executive community keynote recently.

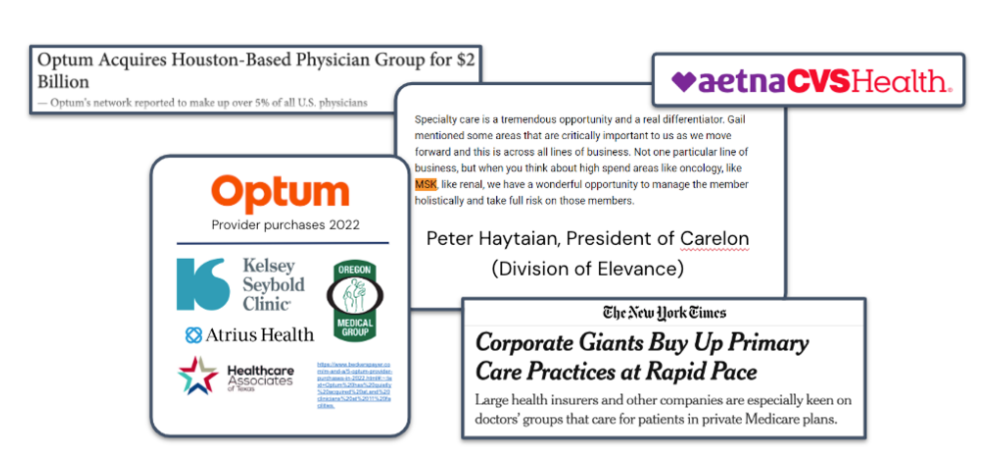

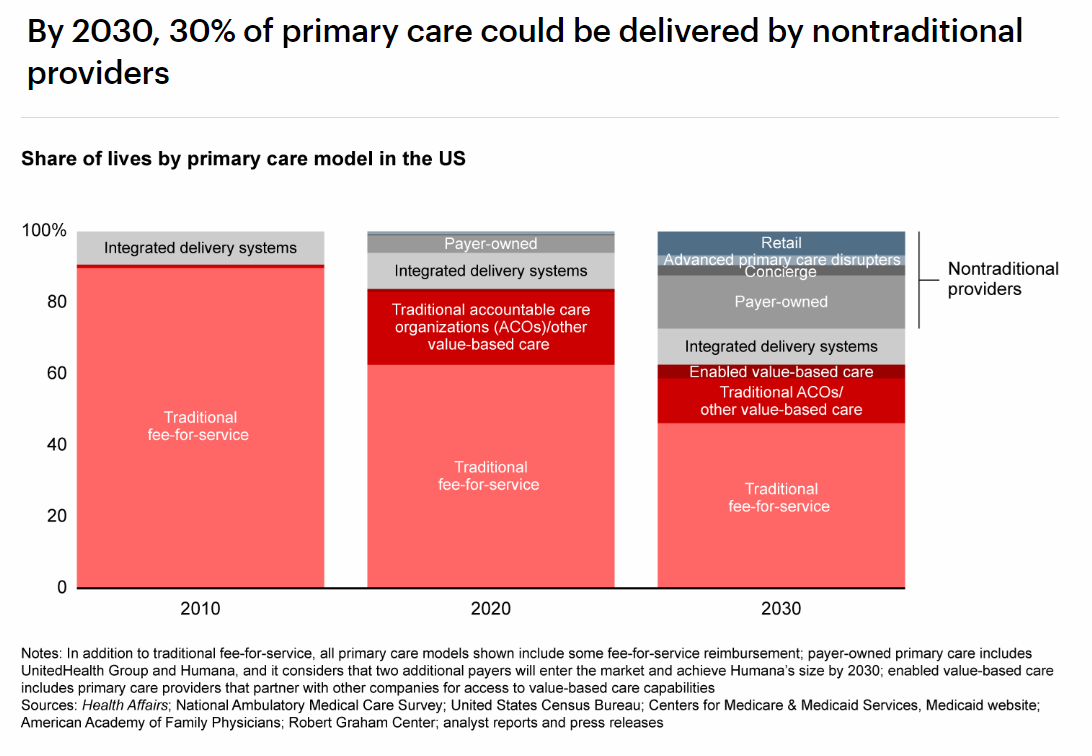

It highlights how the Payors are snapping up primary care providers. The impact on PCP referral streams has already been felt by many in this group. And according to Bain and Company’s ‘Primary Care 2030’ report the growing footprint of these Payviders will serve around 15% of primary care lives by 2030.

But payors buying PCP groups aren’t the only disruptor turning off the referral tap.

The lifeblood of orthopedics has long been the referral. But the veins are getting harder to drink from. (Happy late Halloween and sorry for the horrible vampire joke.)One thing I’m thinking about:Boardroom questions about growthI’m finding myself in more and more ortho group boardrooms. Here are some question patterns I’m seeing emerge.If you’re a CEO be prepared to answer them. If you’re a physician, make sure they’re on your radar.

Why this question matters:As referenced above, the referral patterns are changing. And more importantly, not all referral streams are created equally. To decide where you should go, you have to understand where you are. Outside of the financial statements, most times growth related discussions come up, most struggle to answer with data vs. gut-feel.

Why this question matters: First off, marketing gets a bad wrap and this isn't specific to orthopedic groups; I have the same thoughts at Hatch sometimes. Attribution for marketing spend can be VERY difficult and is probably better for another Ortho 111. But I have seen multiple cases where physicians are asking about their growth investments. Understanding how effectively you are deploying capital to grow your practices is critical and that starts with breaking down that spend into sub-buckets by channel.

Why this question matters: This is a simple question but one that needs a good amount of thought. As 2023 is rapidly coming to an end, many are taking an opportunity to look back and it's easy to forget the good and the bad that happened 11 or 12 months ago. Without a data-backed answer about the successes and failures of your growth, it will be difficult to justify or even determine 2024's plan.Closing thought:The growth equation has changed.Tradition revenue streams are diverting at least or drying up at worst. Surviving, thriving, and remaining independent will be an exercise in flexing new muscles, and a lot of that starts with testing new strategies.Tough conversations are coming.Having your insights, arguments, and plan be data-backed are an absolute must to work the room.(Drop me a note if you have other questions you're seeing come up in Board Meetings that might not have been asked a year or two ago.)One conversation starter:The activation question. Compensation rewards for employees?Feedback from last week's 5A's of an employer offer pinpointed Activation as the toughest 'A'.Here was an interesting thought that came up: compensation rewardsA longstanding price transparency company I’m friends with has an interesting playbook.This company works with large employers and tries to "activate" their employees to use the pricing tool to make good decisions about care selection. Employees get paid by the employer for choosing cost and quality-effective care. The news of getting a check for making a good decision gets shared at the water-cooler and it boosts awareness to other employees and tool utilization – a real flywheel spinner.For Orthopedics, staying visible when the need arises is crucial. Programs like this could make a significant impact.Potential Orthopedics challenges with this approach:

What's your take – could a reward system align with your offerings to employers?Till next week,-AdamFeel free to forward this issue to your circle – but please keep in mind I’m intentionally keeping the distro list small as this is a space where I share my candid thoughts.However, if you feel someone would be good to add to the conversation, I trust you and would be happy to add them.P.SHere’s a bonus:Milwaukee’s transition to a self-insured plan: A mini case studyWritten for Ortho111 by Hatch’s VP of Product, April John MDSign me up for Cheesehead healthcare.The City of Milwaukee's transition to a self-insured plan has curbed its healthcare spending.It now spends ~$15K per employee per year – well below the national average.The highlights:

**So how did the cheeseheads do it?These 5 key initiatives:**On-site Health Services

Coinsurance Model

Wellness Program Achievements

Emergency Care Strategy

Injury Reduction Efforts

My takeaway for Ortho111’ers:The Orthopedic (or any groups) efforts to go direct do not exist in a vacuum. They’re positioned in the context of a larger plan to bend the curve of healthcare toward a higher-quality lower-cost future.